Introduction

As became painfully obvious when pandemic lockdowns began, fast, reliable internet service is a necessity today. A Pew survey released last year found that 90 percent of Americans said the internet has been essential or important to their lives over the course of the pandemic.

Yet the high-speed internet options offered by an internet service provider can vary—even by neighborhood within a city—based in part on how and where it has elected to upgrade its physical infrastructure.

See our data here.

Households in areas with new, state-of-the-art infrastructure are offered download speeds of 200 or more megabits per second (Mbps) of data (we call this “blazing fast” in our analysis). Neighborhoods where ISPs have neglected to make upgrades are offered service that doesn’t meet the FCC’s definition of “broadband,” with download speeds under 25 Mbps of data (we call this “slow” service in our analysis). The benchmark for internet speeds is ever evolving: The agency announced earlier this year that it is considering raising the floor for broadband to 100 Mbps.

Recent research from activists and academics has pointed out a digital divide for high-speed internet between the parts of major American cities where ISPs have upgraded the infrastructure (often rich and predominantly White) and the frequently poorer, predominantly communities of color where they have not made upgrades. Deployment inequalities have been identified in Los Angeles, Cleveland, Dayton, Detroit, and Toledo, and for the entire nationwide footprints of both AT&T and CenturyLink.

Some of this work has labeled this divide “digital redlining,” referring to maps drawn by a federal-government sponsored organization in the 1930s to distinguish neighborhoods that were safe for investment by financial institutions and those that were not. In these “residential security” maps, which were published by the Home Owners Loan Corporation (HOLC) and developed with input from local real estate agents, the “best”-rated neighborhoods were colored in green; the worst were rated “hazardous” and colored in red. Homes in the red, “hazardous” areas were often denied mortgages, hence the idea that certain neighborhoods had been “redlined.” These grades were explicitly based on the racial and wealth makeup of each area’s residents, among other factors. Even today, residents in historically redlined areas are exposed to higher rates of harms ranging from asthma to gunshot injuries.

In a lengthy comment submitted to the FCC earlier this year as part of the agency’s rulemaking process on a digital discrimination initiative, AT&T pushed back on the validity and conclusions of much of this research. In some cases, the company attacked their underlying methodologies. AT&T called a study undertaken by the Communication Workers of America, which represents employees at telecom companies (full disclosure: The CWA is the parent union of The NewsGuild-CWA, which represents The Markup’s employees) self-serving since any resultant broadband expansion to fix inequities would mean more work for its members.

Story Recipes

Journalists: Investigate Which Neighborhoods in Your City Are Offered the Worst Internet Deals

We analyzed more than 800,000 internet service offers in major U.S. cities. Here’s how you can use our data to report local stories

Our analysis differs from previous work by examining pricing in conjunction with speed and the demographics of areas that are offered the same price for worse service (below 25 Mbps)—we call these the “worst deals.” We also examine whether those deals fall more on poorer communities, communities of color, and historically redlined areas. In a 2018 report, the internet accessibility advocacy group National Digital Inclusion Alliance (NDIA) accused AT&T and Verizon of engaging in the practice of charging the same base price for a variety of speeds, based on the companies’ marketing materials, which the authors called “tier flattening.”

Our work went deeper, gathering and examining 1.1 million actual service offers made by carriers. We found that not only is tier flattening rampant but also, in conjunction with inequitable build-out, the result is that people who can least afford internet services are being offered substantially lower quality internet than other people living in the same city, for the same price.

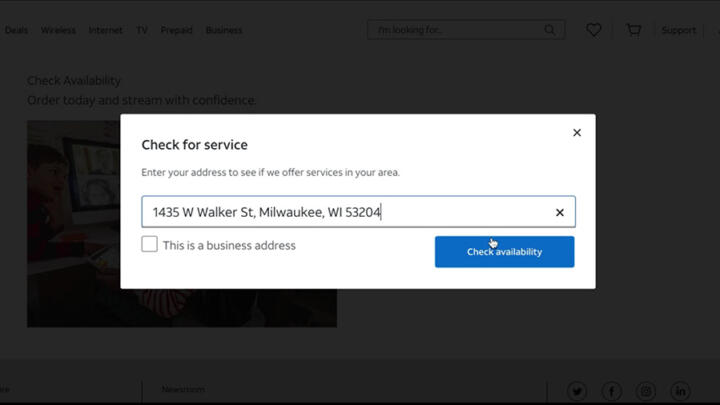

Our research method is modeled on a 2020 Princeton study published in the Proceedings of the ACM Internet Measurement Conference that used an often overlooked information source, the “broadband availability tools” from ISPs’ own websites, to show that the companies were overstating to the FCC where they offered service, particularly in rural areas and neighborhoods where people of color live. (Much of the previous research around internet access relied on data collected by the FCC, which is not reliable. See Limitations: FCC Form 477 for more details.)

Rather than focus on availability, we used those same lookup tools to collect granular information on internet plans offered by ISPs to individual addresses. This allowed us to join information about price and offered speed with the socioeconomic data of the surrounding area and test for patterns among consumers receiving the worst value for the same monthly fee. (Note that we only had access to speeds as offered by the companies on their websites, which tend to be higher than actual speeds customers receive.)

We conducted our analysis on the nation’s largest internet providers that appeared to be practicing tier flattening based on early manual checks of addresses in the lookup tools: AT&T, Verizon, EarthLink and CenturyLink. (See ISP Selection for more details.)

Building off the 2020 study published by Princeton researchers, we discovered and used the underlying APIs of each ISP’s lookup tool, allowing us to search a massive number of addresses at scale. (See Data Collection for more details.)

Between April 15 and Oct. 1, 2022, we gathered internet offers from AT&T’s, Verizon’s, EarthLink’s and CenturyLink’s websites for 1.1 million U.S. residential addresses for 45 cities that we had collected from open sources. (See Data Collection: Getting Addresses for more details.) We focused on the largest city served by at least one of the four ISPs in each state.

We restricted our analysis to major cities rather than rural areas because we wanted to examine areas where the cost and difficulty of deploying broadband technology isn’t affected by extremely low population densities and where variations in speed were in close proximity.

In many cases, the variations in speed for the same price were extreme. CenturyLink offered internet speeds ranging from 0.5 Mbps to 200 Mbps within the same city for $50 a month. As a result, the cost per offered Mbps ranged from more than $100 per Mbps to 25 cents per Mbps. Consumers given the “worst deals” (again, we define these as offers with slow speeds, below 25 Mbps for the same rate) were asked to pay substantially more than others for each Mbps of internet.

To put it plainly, we found these providers offered the worst deals to people who are the most in need of affordable prices for high-quality, high-speed internet.

We used Census block group data and historical redlining maps, where available, to determine the socioeconomic characteristics of areas that were disproportionately offered the worst deals. To do this, we grouped addresses by their area’s median income, racial/ethnic demographics, and redlining grades to compare the proportion of slow speeds offered to each of these groups for each city and ISP.

In cities where the providers offered different speeds in different areas, the residents living in areas that disproportionately received the worst deals were lower income (92 percent of cities) and people of color (66 percent of cities), and their neighborhoods had been historically redlined (100 percent of the 22 cities in our data where digital maps were available). Wealthier, Whiter, and non-redlined areas were offered faster speeds for the same price more often. In all but two (36 of the 38) cities we examined, we found at least one of these three kinds of disparities that led to disadvantaged areas disproportionately receiving the worst deals. (In the other two cities, Boise, Idaho, and Fargo, N.D., we were able to conduct only the income comparison, due to a lack of digitized redlining data and a lack of racial/ethnic diversity.)

To put it plainly, we found these providers offered the worst deals to people who are the most in need of affordable prices for high-quality, high-speed internet.

In addition, we conducted a logistic regression to determine whether business factors such as competition and customer adoption (explanations that ISPs have said play a role in where they choose to upgrade equipment) affected the disparities in who got the worst offers. Even after adjusting for these factors, lower-income, least-White and historically redlined areas still got the worst offers more often than Whiter, wealthier, and historically non-redlined areas in the vast majority of cities we examined. (See Analysis: Logistic Regression for Adjusting the Proportions of Slow Speed for more details.)

Methodology

ISP Selection

We focused our investigation on wireline services (like DSL, fiber, cable), omitting satellite and fixed wireless internet services. (Fixed wireless internet services use an antenna or dish to receive broadcast waves from a tower and include 5G internet by mobile providers.)

Internet accessibility advocates overwhelmingly view high-speed wireline options, also known as fiber, as superior to other forms of internet service, and the federal government’s Broadband Equity, Access and Deployment program prioritizes funding high-speed fiber projects. (A recent report by the Benton Institute, a charitable foundation working to expand internet access, found that “Fixed-wireless technologies … will not match the performance of fiber-optic networks—primarily because the existing and potential bandwidth of fiber is thousands of times higher than wireless.”)

We then identified the ISPs offering terrestrial coverage to the largest percentage of the U.S. population from an analysis based on FCC data by the industry news site FierceTelecom. That list included AT&T, Comcast, Charter, Verizon, and Lumen.

Using the FCC’s Broadband Map, which aggregates and visualizes mandatory ISP reports of their offerings by Census block group, we identified 10 cities at random where each of these ISPs offered service and manually entered 10 random addresses identified through Google Maps into the ISPs’ service availability lookup tools to see if any were charging the same amount of money for different internet speeds in the same city. Of those, we found AT&T, Verizon, and Lumen (which owns CenturyLink) engaging in this pricing practice.

Charter offered some addresses a variety of internet speeds at the same price points, but all speeds were in the “blazing fast” speed category. Therefore, we elected to exclude Charter from our analysis. A recent report by the California Community Foundation and Digital Equity Los Angeles analyzed Charter offers at 165 residential addresses across the Los Angeles area and found that the best offers, with higher speeds at lower price points, tended to go to the wealthiest areas. In an email to the Los Angeles Times, Charter dismissed the report as “intentionally misleading.”

Comcast did not offer different speeds for the same price, so we excluded it from our analysis too.

These results were in line with what the authors of the NDIA report that first identified tier flattening told us in interviews: that the practice was more likely followed by companies offering DSL service over telephone lines originally built for telephone service than by cable internet providers, for technical reasons related to the infrastructure.

We reviewed BroadbandNow’s list of the top DSL providers in the U.S. Earthlink is listed as the number two provider in the county. Earthlink is not listed on the FCC’s Broadband Map, so we selected cities at random for testing based on marketing materials listed on the company’s website. (See EarthLink Overview for more details.) We found Earthlink also engaging in tier flattening.

Data Collection

In our study, our sample consists of offers that AT&T, Verizon, CenturyLink, and EarthLink provided to addresses in the most populous city in each state served by at least one of the four large ISPs.

These four companies offer service in 45 states and Washington, D.C., according to December 2020 reports to the FCC for AT&T, CenturyLink, and Verizon, and a hand-check for EarthLink availability on its own website. (Because EarthLink rents infrastructure from other carriers, it’s not required to report this information to the FCC.) CenturyLink provides service to at least some portion of the population in 36 states, EarthLink in 35, AT&T in 21, and Verizon in 11. (See some limitations with this data source in Limitations: FCC Form 477.)

The only states not served by any of the four companies are Alaska, Hawaii, New Hampshire, Vermont, and Maine.

Getting Addresses

We used two open-source datasets to gather more than 12 million addresses. The main source was OpenAddresses, a project that collects street addresses from non-Federal official sources such as city and state governments, including latitude and longitude coordinates, for every city except for New York. For addresses there, we used a dataset from NYC Open Data. (See Limitations: Testing the Completeness in Open Source Address Datasets for more details.)

For each address, we identified both its Census block group and whether it was in the boundaries of the city by plugging its coordinates into the Census.gov geocoder API. This approach is more reliable than depending on zip codes or city names, many of which were absent from the open-source data we used. Block groups are the smallest geographic unit of the U.S. Census Bureau’s American Community Survey, and their populations range from 600 to 3,000 people.

Collecting Data from Lookup Tools

For each city and ISP, we went through each Census block group and took a random 10 percent sample of the addresses we had collected (called a stratified sampling). If a lookup tool told us that an address was not served, or invalid, we continued to search new addresses until we reached a 10 percent sample of each block group. This is how we collected a representative sample of offers (speed and price) for each city and ISP in our investigation.

We modeled our data collection method on a 2020 study published by a trio of Princeton researchers that revealed ISPs vastly overstated the availability, speed, and competition of their services to the FCC. Using their techniques allowed us to discover and use each lookup tool’s underlying API, allowing us to search addresses at scale. To prevent overloading ISP servers or getting our queries rejected, requests were delayed and routed through a network of residential IPs provided to The Markup by Bright Initiative, the nonprofit arm of the commercial entity Bright Data (until recently called Luminati), which provides nonprofits and academic institutions with free access to tools for scraping public data sources. This is the same company used by the Princeton researchers for this purpose.

For multiunit buildings, we requested speed and price information for only one unit per address. We chose the first unit recommended by each ISP’s address completion system.

We built four scrapers to check the offer data (availability, speed, and price) for 456,134 addresses with AT&T, 312,357 addresses with Verizon, 245,139 addresses with CenturyLink, and 593,334 addresses with EarthLink. We collected the data for all but two cities between April 15 and May 25, 2022; we collected the data for Columbus, Ohio, and Nashville, Tenn., between Sept. 26 and Oct. 1, 2022, due to an earlier error in city selection for those two states.

We were unable to verify that each address we used was a residential address; however, we did take steps to assure we did not collect internet plans for businesses by using the following precautions:

- AT&T: The API requires a specific argument (“customerType” : “business”), which we didn’t use, in order to search for internet plans for business.

- Verizon: The API’s address completion system indicates whether the address is residential or not. We only collected offers for addresses that Verizon’s system suggested were residential.

- CenturyLink: Internet for Business plans are available only by phone and not by using the lookup tool we used to collect data.

- EarthLink: Like AT&T, searching for business plan offers requires a specific API argument.

Altogether, we built a dataset of 1,606,964 queries for offers from four ISPs and 45 cities across every state in the United States, except for Alaska, Hawaii, New Hampshire, Vermont and Maine.

Categorization

Throughout our investigation, we used categorization schemes to group internet offers by speed, and the receiving area’s race and ethnicity, income, and historic HOLC grades.

Speeds

Of the 1.6 million queries we collected, 455,534 corresponded with an address that was not served by a provider. That left us with 1,151,430 actual offers for internet plans. If an address received multiple offers, we focused on the cheapest (base offer), which costs the same amount as all other addresses served by that ISP in the city. Other than EarthLink, the providers did not offer speed upgrades from the slower plans, but only for plans that were already in the blazing category.

We grouped download offers into four speed categories. Our investigation focuses on download speeds because internet plans are primarily listed through download speeds. (Both download and upload speeds listed for all offers are available to the public on our GitHub.) Importantly, the speeds in our investigation are speeds the ISPs say they provide in their offers. We did not check those claims.

Our categories are:

- Slow: Below 25 Mbps download speed. These speeds fall below the minimum threshold for the FCC’s current definition of “broadband” internet. Since all other base-offer speeds cost the same as this level of service, we consider speeds within this range to be among the worst deals for internet service plans.

- Moderate: At or above 25 and less than 100 Mbps. These speeds would not qualify as “high-speed internet” as defined by the U.S. Department of Agriculture for its Re: Connect loan and grant program to subsidize internet infrastructure or meet FCC chair Jessica Rosenworcel’s new proposed definition of what constitutes a broadband connection.

- Fast: At or above 100 and less than 200 Mbps. Met the USDA’s definition of high-speed internet but less than ideal for supporting children in online classrooms and parents working remotely, according to the education advocacy group Common Sense Media.

- Blazing: At or above 200 Mbps download speed. These speeds are recognized by education advocacy nonprofit Common Sense Media as being recommended for a household to maintain multiple, concurrent video conference streams for virtual schooling with minimal interruptions.

Income

We collected median incomes for block groups from the 2019 five-year American Community Survey, the most recent and reliable socioeconomic data. Although 2020 data was available, the COVID-19 pandemic significantly reduced survey responses, making the results nonrepresentative. (The Census Bureau does not publish data on individual households, nor on Census blocks, the geographic units of which block groups are composed.)

Within each city we categorized addresses by income using quartiles (“lower,” “middle-lower,” “middle-upper,” “upper”) based on the median household income of an address’s block group. We used quartiles to approximate the same number of addresses in each category. In cases when so many addresses carried the same value that they crossed a quartile boundary, we moved the quartile boundary to just below that value so that addresses with that value were assigned to only one quartile.

If the American Community Survey did not have an estimation of median household income, we did not analyze that block group for income-based disparities.

Race and Ethnicity

Within each city we categorized addresses by race and ethnicity using quartiles (”least White,” “less White,” “more White,” “most White”) based on the percentage of residents identifying as non-Hispanic White in the address’s block group. As with income, we got this data from the 2019 five-year American Community Survey. The quartile labeled “least White” represents the greatest concentration of people of color in a city, whereas the quartile labeled “most White” represents the greatest concentration of White people in the city. (See Limitations: Different Categorization Systems for other categorization systems we considered for income and race and ethnicity.)

Redlined Areas

We relied on the University of Richmond’s Mapping Inequality project, an online repository of residential “mortgage security” maps and other associated documents from the HOLC, to categorize historically redlined neighborhoods.

The phrase “redlining” is associated with D-rated areas, which HOLC deemed too “hazardous” to secure loans. Most households were rated by the HOLC to be in C or “declining” areas. Fewer houses were in “desirable” areas, with a B rating, and even fewer in “best” areas, rated A. A and B grades were often reserved for affluent White neighborhoods.

We merged HOLC grades to addresses by checking if an address’s coordinates fell within the boundaries of graded areas to which we had access. The digitized maps don’t include every map created by the HOLC, since some were never digitized by the researchers at Mapping Inequality. Further, some cities in our data were never mapped by the HOLC. As a result, we only have maps for 22 cities. In addition, city growth in the decades since redlining was outlawed by the federal Fair Housing Act in 1968 means that some portions of cities are not included in the maps.

Analysis

AT&T Overview

We searched 432,303 addresses from 20 cities using AT&T’s lookup tool and collected the results. We found that 19 percent of addresses overall were not served by AT&T. Service gaps were greatest in New Orleans (51 percent), Chicago (31 percent), and Huntsville, Ala. (28 percent). Internet service providers do not claim to the FCC to serve every block group or address in a city.

After filtering out the addresses without service, we analyzed the resulting 349,703 AT&T internet offers for addresses in 20 cities. The company offered different speeds to different areas, varying from slow to blazing in each city. The price for these starting plans remained the same regardless of the service level: $55 a month.

AT&T provided the option to pay for faster speeds only to households where the starting offer was already 200 Mbps or more (“blazing fast” speeds). No other addresses were offered the ability to upgrade service.

When we standardized the price for each Mbps of service, we found that AT&T offered consumers rates that ranged from $71.61 per Mbps (for speeds of 0.768 Mbps) to 18 cents per Mbps (for speeds of 300 Mbps), meaning some customers were asked to pay 398 times as much as others per Mbps.

CenturyLink Overview

We searched 186,611 addresses from 15 cities using CenturyLink’s lookup tool. We found that 4 percent of addresses overall were not served by CenturyLink. This happened most often in Omaha (14 percent) and Las Vegas (12 percent). Internet providers do not claim to the FCC to serve every address in a city.

We analyzed the resulting 180,067 offers. Like AT&T’s, CenturyLink’s speed offers varied by area but the price remained the same regardless of speed, $50 per month.

Like AT&T, CenturyLink provided the option to pay for faster speeds only to households where the starting offer was already 200 Mbps or more (“blazing fast”).

When we standardized the price for each Mbps of service, we found that CenturyLink offered consumers rates that ranged from $100 per Mbps (for speeds of 0.5 Mbps) to 25 cents per Mbps (for speeds of 200 Mbps), meaning some customers were asked to pay 400 times as much as others per Mbps.

Verizon Overview

We searched 282,622 addresses from nine cities using Verizon’s lookup tool.

We found that 21 percent of households were not served by Verizon. This happened most in Wilmington, Del., where 67 percent of addresses were not served, and New York City where 30 percent of addresses were not served. Internet providers do not claim to the FCC to serve every address in a city.

In five cities, Verizon’s offered speeds were virtually homogeneous (with the same base plan speeds for at least 95 percent of addresses receiving offers). Take, for example, Baltimore, where 99 percent of offers were for slow speeds. The absence of Verizon FiOS is something activists in the city–where one-fifth of residents live in poverty—have complained about for more than a decade. The opposite trend is present in New York City, where 99 percent of base offers were for blazing fast speeds. We removed these two cities, plus Philadelphia, Boston, and Providence, from our socioeconomic analyses of Verizon’s offers because they do not contain enough variation to observe meaningful differences. Additionally, due to the high volume of addresses that were not served by Verizon in Wilmington, we were only able to collect 825 offers. We removed this city from further analyses because the sample size was too small.

We analyzed the resulting 32,886 addresses in three cities. The starting rate for internet plans was $40. However, sometimes it was $50. We presume this to be the result of price testing, as the increased prices were not related to speed. (See Limitations: Lookup Tools Responses for more details.)

As with AT&T and CenturyLink, Verizon provided the option to pay for faster speeds only to households where the base offer was for 200 Mbps or higher (“blazing fast”).

When we standardized the price for each Mbps of service, we found that Verizon offered consumers rates that ranged from $26.67 per Mbps (for speeds of 1.5 Mbps) to 13 cents per Mbps (for speeds of 300 Mbps), meaning some customers were asked to pay 205 times as much as others per Mbps.

EarthLink Overview

We searched 565,752 addresses from 35 cities using EarthLink’s lookup tool. Just under a third, 28 percent of households, were not served by EarthLink.

EarthLink does not own its own infrastructure but rather leases lines from AT&T, CenturyLink, and Frontier in the cities in our analysis and sometimes adds a premium to the rate. We did not find Frontier using tier flattening, and we also did not find it in the cities where EarthLink leases lines from that company (Bridgeport, Conn., and Charleston, W.Va.), so we did not include those cities in our analysis of EarthLink.

In 14 cities, in all of which it leased lines through CenturyLink, EarthLink only offered slow speeds. This includes Seattle, Phoenix, and Denver. Because there were no variances in speed, we also dropped these cities from further analysis of EarthLink’s offers.

That left 285,962 offers from 19 cities where Earthlink offered service and where speeds varied inside the cities. Most were served using AT&T’s infrastructure, with less than one percent of households served using CenturyLink’s infrastructure.

We found that EarthLink charged $50 for plans in areas where it leased from CenturyLink and $60 for plans where it leased from AT&T, regardless of speeds offered. This cost is the same as CenturyLink’s base offer, but EarthLink was $5 more expensive than AT&T in areas where it leases lines from AT&T. (Sometimes EarthLink offered even slower service than AT&T for more money. For example, in Milwaukee, AT&T offered a household 300 Mbps for $55, but EarthLink offered the same home 3 Mbps for $60.)

In two cities where we collected offer data months later than the others (Columbus and Nashville) we found variances in EarthLink’s pricing. EarthLink charged $55 for 12 Mbps plans, while base plans for 3, 6 and 100 Mbps remained $60.

We did not find any cities where EarthLink’s base plans offered blazing fast speeds (at or above 200 Mbps).

Unlike other providers, EarthLink offered (some, but not all) addresses with base offers for slow, moderate, and fast speeds the option to upgrade to faster service—but that’s because they often offered even slower base speeds than the provider they lease lines from. For instance, for some addresses, CenturyLink quoted a base plan of 200 Mbps and Earthlink quoted a base plan of 10 Mbps. (We found these downgrades in 61 percent of EarthLink’s offers.) EarthLink offered those slow speed addresses upgrades up to 5,000 Mbps for more money.

When we standardized the price for each Mbps of service, we found that EarthLink offered consumers rates that ranged from $19.98 per Mbps (for speeds of 3 Mbps) to 60 cents per Mbps (for speeds of 100 Mbps), meaning some customers were asked to pay 33 times as much as others per Mbps.

Who Gets Slow Speeds?

For the analysis of the socioeconomic factors of the areas where residents get the best and worst offers, our dataset consists of 848,618 offers from AT&T, CenturyLink, EarthLink, and Verizon in 38 cities across the U.S.

We looked at three socio-economic factors: relative income, relative percentage of White residents, and grades on historical redlining maps.

We found that all four ISPs offered consumers slow speeds more often in low-income, least-White, and historically redlined areas in the same city. At least one of these three kinds of disparities was present in every city we tested, except for Fargo and Boise.

A stark example is Kansas City, Mo., a city segregated along the north- to south-running Troost Avenue. AT&T disproportionately offered consumers in lower-income areas of Kansas City the worst deals (less than 25 Mbps for $55). For example, more than 54 percent of addresses in lower-income areas received the worst deals, compared to only 11 percent in upper-income areas. Similarly, AT&T disproportionately offered Kansas City residents living in areas with the most people of color the worst deals. The same pattern was found for what AT&T offered residents living in historically redlined areas.

(To see the same plots for other ISPs and cities, refer to GitHub.)

For each ISP, and within each city, we compared the proportion of slow speed offers along three lines: lower- versus upper-income areas, areas with the highest proportion of White residents versus those with the lowest proportion, and HOLC-rated “hazardous” areas versus “best” and “still desirable” areas.

We consider a disparity to exist when the difference of the proportion of slow speeds between any of the comparisons is five percentage points or more. We used this threshold to account for uncertainty and noise that can be introduced from sampling. We purposely did not run statistical tests with p-values because, as advised by statisticians we consulted, we can’t assume independence between addresses’ offers, an assumption required for Student’s t-tests, Chi-squared tests, and z-tests. (See Limitations: Where Are the P-Values? for more detail.)

We were unable to analyze every city in our data because some cities were not racially or ethnically diverse. Additionally, some cities were either never rated by the HOLC or those records were never digitized. We only ran comparisons in cities if at least 5 percent of addresses were in areas where less than 50 percent of the surrounding population was White or people of color or contained HOLC ratings. These thresholds were created to filter out cities that do not contain enough variance for a meaningful comparison.

There were multiple cases of different providers (up to two) in the same city, which we refer to as “city-ISP pairs.”

To see detailed information about each city-ISP pairs’ speeds, refer to GitHub.

Income

In the vast majority of cities we tested, we found that the companies disproportionately offered residents in lower-income areas slow speeds for the same price as they offered for higher speeds to residents living in wealthier areas.

We tested 38 cities (and 57 city-ISP pairs) for patterns in the income levels of who gets the worst deals. We were unable to analyze five cities (and 19 city-ISP pairs) because the companies offered uniform speeds across those municipalities.

We found that 92 percent of the 38 cities and 83 percent of the 57 city-ISP pairs exhibited a disparity between the percentage of lower-income and upper-income addresses offered the worst deals. Seven percent (three) of the cities and 18 percent (ten) of the city-ISP pairs exhibited small or no disparities in the income levels of those offered slow speeds.

Among providers, we frequently found disparities between the percentage of addresses in lower-income and upper-income areas that were offered the worst deals. For Verizon, this was the case in every city, and for AT&T, this was the case for all but one of the 20 cities (95 percent). For EarthLink and CenturyLink, it was the case in 63 and 87 percent of cities, respectively.

Prospective AT&T customers in Oklahoma City who live in poor areas frequently and disproportionately got the worst deals. AT&T offered $55 plans for slow speeds to 53 percent of addresses in lower-income areas but only 7 percent of addresses in upper-income areas, a difference of 46 percentage points. Of all the cities and providers, AT&T’s service in Oklahoma City exhibited the greatest disparity in the percentage of the worst deals between income groups.

AT&T’s worst internet deals in Kansas City, New Orleans, and Charleston, S.C., were also heavily skewed toward addresses in lower-income areas. EarthLink, which leases AT&T’s infrastructure in these cities, followed the same pattern.

In Washington, D.C., 32 percent of potential Verizon customers in lower-income areas were offered the worst deals compared to just 13 percent in upper-income areas.

We also found the same pattern in offers by CenturyLink, the most notable being in Minneapolis, where more than half of addresses in lower-income areas were offered slow speeds for $50, compared to 8 percent of addresses in upper-income areas.

Race and Ethnicity

We also found disparities in the racial and ethnic makeup of the areas where residents got the worst internet deals in most cities we tested. Residents in the least-White areas were disproportionately offered slow speeds for the same price as higher speeds offered to areas with the most White residents.

We tested 32 cities (and 50 city-ISP pairs). In addition to the five cities (and 19 city-ISP pairs) that were offered uniform speeds, we were unable to analyze six cities (and seven city-ISP pairs) because they were not racially and ethnically diverse. In total, we could not analyze 11 cities and 26 city-ISP pairs.

In 66 percent of the 32 cities and 52 percent of the 50 city-ISP pairs, we found a disparity between the proportion of the worst deals offered to areas with the most and least White residents. Of the rest, 34 percent of cities (11) and 48 percent of city-ISP pairs (22) exhibited little or no disparity in the offers provided to the areas with the most and least White residents.

Among providers, we found that AT&T disproportionately made the worst offers to areas with the least White residents in 63 percent of cities (19) it served. Verizon did so in 50 percent of the cities (2) it served, CenturyLink in 64 percent of cities (11) it served, and EarthLink in 33 percent of cities (18) it served.

For addresses in the least-White areas of Oklahoma City, AT&T offered the worst deals to 51 percent of addresses. It offered those deals to only 11 percent of addresses in the areas with the most White residents.

In a majority of cities it serves, we found disparities in the racial makeup of the areas where AT&T tended to offer the worst deals, with higher than 25 percentage point gaps in Kansas City, New Orleans, and Louisville, Ky. EarthLink serviced these same cities through leases with AT&T and followed the same pattern.

In Las Vegas, CenturyLink offered the worst deals to 71 percent of addresses in the least-White areas of town, compared to 40 percent of addresses in the most-White areas (a difference of 31 percentage points).

Redlined Areas

Lastly, and most remarkably, in every city we were able to test, we found that people living in areas that had decades ago been deemed “best” and “desirable” by the HOLC received higher speeds for the same price as slow speed offers extended to residents in areas that had been graded “hazardous.” The one exception is Nashville, which exhibits this disparity for offers by AT&T but not for EarthLink.

We tested 22 cities (and 35 city-ISP pairs). In addition to the five cities and 19 city-ISP pairs that we were unable to analyze because addresses there were offered uniform speeds, we were unable to analyze 16 cities (and 23 city-ISP pairs) because they were either never graded by the HOLC or maps were never digitized. In total we omitted testing 21 cities and 41 city-ISP pairs in our redlining analysis.

The disparity was greatest in Kansas City, Mo., where AT&T offered 68 percent of addresses in “hazardous” graded areas the worst deals, compared to 12 percent of addresses in areas rated “best” and “desirable.” We found disparities of a similar magnitude in other markets served by AT&T, such as Detroit. Likewise, we found that CenturyLink disproportionately offered the worst deals to addresses in historically redlined areas of Minneapolis, Phoenix, and Des Moines. In each of these cities, more than half of addresses in redlined areas were offered the worst deals.

In Newark, N.J., we found that Verizon offered addresses in “hazardous” graded areas the worst deals 21 percent of the time, compared to 2 percent in areas with “best or “desirable” ratings.

Logistic Regression for Adjusting the Proportions of Slow Speed

ISPs are adamant that their practices are nondiscriminatory and based on sound business decisions.

In a recent comment to the FCC, AT&T denied claims of discriminatory broadband access, which it instead attributed to “issues of technical and economic feasibility” as well as “lagging adoption rates in some communities, especially among low-income households.”

To be clear, ISPs’ decisions about where to upgrade equipment that would allow for faster speeds is separate from the broader issue of why the ISPs have decided to charge the same price for drastically different speeds of service, some of which is substandard, especially given the demographics of where that low-quality service is offered.

Still, we ran a logistic regression that accounted for variables that critics, industry professionals, and academics suggested would be relevant to the outcome of an ISP not upgrading service in a particular area—and to which we had access—to see if it eliminated the disparities. (We were not able to account for every possible variable. See Appendix: Independent Variables for more details.)

The variables we used were:

- Population density: A low number of potential customers in a given area is viewed as a financial barrier for infrastructure development. ISPs allege that return on investment decreases in sparsely populated areas. In the same comment to the FCC mentioned earlier, AT&T acknowledged that “fiber deployments are concentrated in areas with higher household density.” It states that “Household density, not median incomes, drives these deployments.” Adjusting for population density (using people per square mile) helped us isolate the influence of socioeconomic factors between areas with different population densities, such as urban and suburban areas in the same city.

- Competition: Industry professionals and advocacy groups have suggested that the number of competing ISPs serving the area is an incentive for ISPs to offer competitive pricing and faster speeds. The Institute for Local Self-Reliance found that AT&T “almost exclusively upgraded its networks to offer broadband-level service only in areas where it faces competition.” Similarly, the economic consulting firm Analysis Group found that competition in a market tended to lower prices and boost speeds. We measured this value using the number of wired internet providers listed in the FCC’s Form 477 for each block group.

- Broadband adoption rates: As stated above in AT&T’s comment to the FCC, the company blamed inequitable broadband access on "lagging adoption rates.” The American Community Survey keeps track of broadband adoption rates for U.S. households.

See Appendix: Independent Variables for more details.

We ran a binary logistic regression that incorporated these variables to see if adjusting for them would affect the socio-economic disparities we observed in our analyses above.

Although an ordinary least squares (linear) regression would yield a relationship between variables such as dollars of median income and download speeds (for example, for every $10 above the city’s median income, consumers were offered two more Mbps for the same price), a finer-grained analysis of such relationships is beyond the scope of our analysis. Instead, we focused on who gets the worst deals.

We chose binary logistic regression to analyze disparate outcomes between groups. With binary logistic regression, we can calculate the probability of an outcome (getting offered slow internet speeds) on a holdout group (such as “lower-income” areas) compared to an exposure group (such as “upper-income” areas). Logistic regression allows us to convert model outputs into probabilities and compare the “adjusted” probabilities to the observed probabilities. We get the adjusted percentage point difference by calculating the probability of an outcome for each group (such as low-income and upper-income) after factoring in other variables and taking the difference of the two probabilities.

The magnitude of the difference between the observed and adjusted percentage point differences helps us understand whether business factors may explain some of the observed disparities in speeds. For example, if the observed disparity between the proportion of slow speeds offered to two income groups is 25 percentage points (30 percent for lower income compared to 5 percent for upper income) and the adjusted disparity is only one percentage point, the variables that the model factored in are stronger correlates to slow speeds than income alone.

We ran three logistic regression models for each city and ISP. Each tried to predict whether the ISP offered a household the worst deal (slow internet speeds for the same cost as faster speeds) using the variables above plus one additional independent variable—income, race, or HOLC grades—for each model.

Those additional independent variables were divided into three separate models to avoid potential confounding effects between historical and socioeconomic factors. We found that population density, competition, and adoption rates appeared to explain some, but not all, of the observed disparities.

In other words, even accounting for business decisions that could affect upgrading equipment, low quality, low value internet offers remained more common for areas where fewer residents were White and incomes were lower and that had been historically redlined.

In the next sections, we outline the detailed findings for each of the three regressions.

Income

For more than two-thirds of cases—68 percent of cities (26 out of 38) and 69 percent of city-ISP pairs (40 out of 58)—adjusting for additional factors reduced, but did not eliminate, disparities (below a five percentage-point difference) between addresses in lower- and upper-income areas.

We found that the median McFadden’s pseudo r-squared was 0.06 for the 58 city-ISP pairs, 83 percent of city-ISP pairs had an odds ratio above 1.5 for the income variable, and 90 percent of city-ISP pairs had p-values below 0.05 for the income coefficient. (All model outputs can be found on our GitHub. See why p-values could be inaccurate in Limitations: Where Are the P-Values?)

Adjustments that reduced disparities were especially pronounced in Omaha (CenturyLink), Minneapolis (CenturyLink), and Seattle (CenturyLink).

In Seattle, adjustments resulted in a much smaller disparity between addresses in lower-income and upper-income areas that were offered the worst deals. Still, the disparity remained.

In Virginia Beach, however, adjusting for additional factors increased the disparity between Verizon’s slow speeds in lower- and upper-income areas. When we looked at addresses with similar attributes but different income groups, the additional factors appeared to have strengthened the relationship between income and who got the worst offers. This also occurred in Washington, D.C., and Newark, which are served by Verizon, as well as in Huntsville (AT&T and EarthLink), Nashville (EarthLink), Wichita (EarthLink), Cheyenne, Wyo. (CenturyLink), and Boise (CenturyLink). In these cases, the logistic regression suggests that adjusting for disparities in business factors do not explain the disparities between income groups but rather makes them seem more extreme.

To determine which business factors exerted the greatest change against the observed disparities, we retrained each logistic regression, removing one factor at a time (called an ablation study). We chose this approach rather than comparing coefficients because each factor was standardized in such a way that intuitive interpretations were not possible.

The factors that exerted the greatest adjustments to observed income-based disparities were the existing broadband adoption rates (48 percent of city-ISP pairs) followed by the number of competitors in the area (34 percent of city-ISP pairs).

Race and Ethnicity

For one-third of cases—31 percent of cities (10 out of 32) and 28 percent of city-ISP pairs (14 out of 51)—adjusting for additional factors did not eliminate disparities (below a five percentage point difference) between addresses in the least-White and the most-White areas.

We found the median pseudo r-squared was 0.07 among the 51 city-ISP pairs, 45 percent of city-ISP pairs had an odds ratio above 1.5, and 78 percent of city-ISP pairs had a p-value below 0.05. (All model outputs can be found on our GitHub. See why we don’t include p-values in Limitations: Where Are the P-Values?)

In some cities, adjusting for other factors reduced the disparity between the least- and most-White areas but did not eliminate them. This was especially pronounced in Louisville (AT&T and EarthLink), Kansas City, Mo. (AT&T and EarthLink), and New Orleans (AT&T and EarthLink).

Accounting for additional factors did not affect racial and ethnic disparities in Atlanta (AT&T and EarthLink), Chicago (AT&T), Indianapolis (EarthLink) and Los Angeles (EarthLink).

Adjusting for additional factors eliminated disparities between the least- and most-White areas in Wichita (AT&T), Seattle (CenturyLink), Sioux Falls, S.D. (CenturyLink), Minneapolis (CenturyLink), and Omaha (CenturyLink).

In Omaha, where the adjusted percentage point difference disparity was almost zero (dropping more than 31 percentage points from the observed disparity), competition was more strongly correlated to slow speeds than race and ethnicity alone.

Racial and ethnic disparities were reversed in Charleston (AT&T) after adjusting for broadband adoption rates. Similarly, cities that showed little-to-no disparity without adjustments, such as Milwaukee (AT&T), Washington (Verizon), and Albuquerque (CenturyLink), exhibited a reverse disparity after adjusting for other factors.

The factor that led to the largest adjustment against observed values for racial and ethnic disparities (in about 45 percent of city-ISP pairs) was broadband adoption rates, followed by competition and the population density (in 33 and 22 percent of city-ISP pairs, respectively).

Redlined areas

For almost two-thirds of cases—59 percent of cities (13 out of 22) and 56 percent of city-ISP pairs (20 out of 36)—adjusting for additional factors did not eliminate disparities (below a five percentage point difference) between the worst internet deals offered to addresses in the areas deemed “hazardous” and those deemed “best” and “still desirable” by historical maps.

We found that the median pseudo r-squared was 0.11 for 36 city-ISP pairs, 83 percent of city-ISP pairs had an odds ratio above 1.5, and 92 percent of city-ISP pairs had a p-value below 0.05. (All model outputs can be found on our GitHub. See why we don’t include p-values in Limitations: Where Are the P‑Values?)

We found that disparities between redlined and non-redlined areas were reduced, but not eliminated, in most cities. This was most pronounced in Kansas City. Mo. (AT&T and EarthLink), and Minneapolis (CenturyLink).

In Louisville (EarthLink), these factors did not explain the observed variation between slow speeds in redlined areas and non-redlined areas. The same was true for Omaha (CenturyLink) and New Orleans (EarthLink).

In Louisville (AT&T), the disparity between redlined areas and non-redlined areas greatly increased after we adjusted for other factors, mainly population density. This also occurred in Newark (Verizon) and Phoenix (CenturyLink).

Disparities were eliminated after adjusting for other factors for Charlotte and Los Angeles. In Los Angeles, we found that population density was more correlated to slow speeds than differences in HOLC grades alone.

The factor that exerted the greatest adjustment against observed values (in about 58 percent of city-ISP pairs) was population density, followed by adoption rates (in 28 percent of instances).

The adjustments we see demonstrate that where a provider chooses to continue offering slow speeds may be associated with various factors, many of which we were unable to encode. Yet even after considering business factors and making adjustments, the strong pattern of disparities we observed in the demographic factors of who received the worst offers across major cities remained.

For a detailed overview of the logistic regression model outputs such as p-values, coefficients, odds ratios, probabilities, and McFadden’s pseudo R2, please refer to GitHub.

Limitations

Testing the Completeness of Open-Source Address Datasets

To test how complete OpenAddresses is in each city, we compared the number of addresses it provides against the number of households estimated from the American Community Survey between 2016 and 2020. Note that the ACS defines households as “separate living quarters,” which could include entire homes, apartments, mobile homes, and single rooms.

We found that OpenAddresses covered at least 25 percent of housing units recorded in Census data in every city we checked except for New York City, where it only covered less than 2 percent. This pattern is likely because the Census counts each individual apartment in multiunit buildings, but secondary addresses are not always in OpenAddresses addresses. As we only used one address per multifamily building for our analysis, we would not have needed every unit. In New York City we used address data from NYC Open Data instead of OpenAddresses. Compared to Census estimates, this data source covered 26 percent of housing units in New York City.

To test that address data did not contain geographical biases, we mapped all available addresses and performed a visual check to make sure there were no large blank areas that were not on green space or water on the map.

Lookup Tools Responses:

Sometimes we found Verizon offering rates that were $10 higher than the usual $40. To test this, we checked prices in Boston twice. We found that Verizon’s offer for the same addresses arbitrarily changed between $40 and $50. This appears to be price testing.

Therefore, we considered $50 offers to be no different from $40 offers and included them in our analysis of tier flattening.

Verizon did not respond to our questions about price testing.

FCC Form 477

Much of the research about internet access has relied on data collected by the FCC through Form 477, which requires ISPs to submit their current offerings in the U.S. by geography to the agency twice a year.

This data is notoriously full of holes. It counts an entire Census block group, which can house up to 3,000 people, as served if an ISP claims it offers service, or could soon offer service, to a single address in an area.

These limitations are made clear in previous studies, many of which we cite in this methodology..

Where Are the P-Values?

An assumption required to use statistical tests like the Student’s t-test, chi-squared test, and z-test is that each data point has independence. A statistician who reviewed an earlier draft of our analysis warned us that we could not prove that internet offers were independent from one another because ISPs may provide the same plans to geographic areas. Although we observed instances of variation in offers within Census block groups, we do not know what geographic units ISPs use to determine speeds (which is likely not by Census block groups). So, out of caution, we have decided not to treat observations as independent of one another. That said, switching our threshold from that used in our main analyses (a five percentage-point difference) to a threshold based on p-values would have led us to categorize more city-ISP combinations as displaying disparities.

Different Categorization Systems

With respect to income, the analyses above categorize each address by the median income of its Census block group, placing each address into one of four quartiles. The boundaries between each quartile are determined on a per-city basis, so that one-quarter (or as close to that as possible) of the addresses fall into each quartile in each city. We took a similar approach to categorizing addresses by race/ethnicity but used the relevant Census block group’s proportion of residents who identify as “Not Hispanic or Latino, White alone” as the key variable. We chose these approaches to account for each city’s unique socioeconomic condition while allowing for comparisons across cities. We explored other approaches and found that our findings remained largely unchanged.

In our income analysis, for instance, if we had used the Community Reinvestment Act’s definition of low and upper income instead and compared a block group’s median household income to the median household income for the city, we would have found disparities in 92 percent of city-ISP pairs and 97 percent of cities, slightly more than in the approach we settled on, which revealed disparities in 83 percent of city-ISP pairs and 92 percent of cities.

For race and ethnicity, if we had set a fixed threshold of 0–40 percent White population for “least White,” 41–60 percent for “integrated” areas, and 61–100 percent for “most White,” we would have found disparities in 51 percent of city-ISP pairs and 60 percent of cities. This is a slightly lower percentage of disparities than in the approach we settled on, which found disparities in 51 percent of city-ISP pairs and 60 percent of cities.

The downside to the other approaches we considered, however, is they would have meant comparing vastly different sample sizes across socioeconomic groups. Sometimes this would have meant empty, or near-empty, categories, making certain cities unanalyzable. For example, in Charleston, if we’d used the Community Reinvestment Act’s definitions, we would have had 2,141 addresses in the upper-income areas compared to only 291 addresses in areas that qualified as low income. Sample sizes this small are not reliable for analysis, especially without the use of p-values.

The data used for this investigation is available to the public on our GitHub.

Companies’ Responses

In September we sent draft copies of this methodology, along with a list of questions, to each of the ISPs we investigated. None disputed the core, underlying finding—that they were charging the same amount for different levels of service.

The principal complaint raised by AT&T is that the company offers reduced-cost plans to some low-income residents and that the federal government also provides $30 monthly subsidies to low-income residents under a new federal program that was part of the 2021 infrastructure bill ($75 for those living on tribal lands).

“Your analysis is fundamentally flawed as you clearly ignored our participation in the federal Affordable Connectivity Program and our low-cost Access by AT&T service offerings. Eligible consumers can receive free internet service when combining the $30 federal subsidy with our low-cost options,” wrote AT&T assistant vice president Jim Greer in a statement. “Any suggestion that we discriminate in providing internet access is blatantly wrong.”

A report released earlier this year found that only about one-third of eligible households in 30 major U.S. cities had signed up for ACP. And more than half of those who had signed up by early October were using it to cover the costs of mobile phone service rather than wired home internet connection (which is allowed).

Greer insisted AT&T has “run a broad campaign to market and sign-up eligible customers for the ACP” but declined to disclose the number or percentage of AT&T customers who have been approved for either the ACP or the company’s in-house low-cost plan for low-income residents.

In addition, it’s important to note that while some lower-income areas are also among the least-White areas, that was not always the case. In every city served by AT&T in our data, there were some least-White areas that were not among the lowest-income areas.

Greer suggested in a follow up email that had we averaged all internet offers in each block group, including possible upgrades, the disparities in Mbps per dollar would have been reduced. He did not provide those alternative statistics or any data.

Verizon spokesperson Rich Young declined to answer our questions directly, instead referring us to the industry group USTelecom. USTelecom senior vice president Marie Johnson insisted internet providers had a valid reason for charging the same price for slow service as fast service: “Fiber can be hundreds of times faster than legacy broadband—but that doesn’t mean that legacy networks cost hundreds of times less,” Johnson wrote. “In fact, operating and maintaining legacy technologies can be more expensive, especially as legacy network components are discontinued by equipment manufacturers.”

EarthLink’s press office did not respond to repeated requests for comment. The company delivers service over infrastructure owned by other providers in the cities we examined and thus is limited in the top-end speeds it can provide.

CenturyLink’s parent company sent a brief email response. “We do not engage in discriminatory practices like redlining and find the accusation offensive,” wrote Lumen spokesperson Mark Molzen. “We do not enable services based on any consideration of race or ethnicity and the methodology used for the report on our network is deeply flawed.”

Molzen’s email did not highlight any specific flaws in our analysis and he did not respond to our further requests for more detail.

Conclusion

AT&T, CenturyLink, EarthLink, and Verizon offered households in the same city the same price for vastly different levels of service, disadvantaging households in lower-income, least-White, and historically redlined areas.

When we looked at value for money, CenturyLink’s pricing ranged from just $0.25 per Mbps all the way up to $100 per Mbps for its slowest speed connections. That’s 400 times as much money per Mbps. Gaps for AT&T, Verizon, and EarthLink were 398 times, 205 times, and 33 times, respectively.

In 92 percent of the cities we examined, the worst deals were disproportionately offered to addresses in lower-income areas. In 66 percent of cities, the worst deals disproportionately went to households in the least-White areas. In all 22 cities where we were able to obtain digitized HOLC residential security maps, the worst deals overwhelmingly went to historically redlined areas.

Even after adjusting for other factors that may influence ISPs’ decisions about where to deploy high-speed internet infrastructure (like population density, broadband internet adoption rates, and number of competitors), the disparities we found within lower-income, least-White, and historically redlined areas remained in most cases.

The providers’ defenses were principally that antiquated infrastructure is expensive to maintain and that their own low-cost and federally subsidized internet plans are available for low-income households that qualify—and know to apply.

Even so, the combination of this pricing scheme and a history of inequitable deployment of high-speed internet infrastructure has exacerbated the digital divide where residents of historically marginalized areas of major American cities were disproportionately asked to pay high-speed prices for low-quality internet service.

Appendix

Independent Variables

The variables below are used to predict the dependent variable: whether an address was offered slow internet speeds.

- Income: We use block-group-level median income from table B19013—Median Household Income in the past 12 months, from the 2015–2019 American Community Survey five-year estimates. This data is bucketed into quartiles (“lower,” “middle-lower,” “middle-upper,” and “upper” income) based on the block group’s median income. These buckets are treated as categories with upper income used as a treatment (holdout) group compared to lower-income areas.

- Race and ethnicity: We use block-group-level population estimates from table B03002—Hispanic or Latino origin by race, from the 2015–2019 American Community Survey five-year estimates. We create quartiles (“least White, “less White”, “more White”, “most White”) based on the percent of a block group’s population that is non-Hispanic White. The quartiles are treated as categories with “most White” used as a treatment (holdout) group compared to “least White”.

- Redlining: Historic HOLC grades of A, B, C, and D. D grades are considered redlined areas. The grades are treated as categories with the highest graded areas (A and B) used as a treatment (holdout) group compared to D graded areas. Historically, A and B grades were given exclusively to middle- to upper-income White areas. These areas were viewed as low-risk for loan defaults.

- Population density: The population divided by the land area of the block group. Population estimates are from the 2015–2019 five-year American Community Survey (B03002), and land area is from the Census Bureau’s 2019 TIGER shape files. This was standardized using Scikit-Learn StandardScaler, with zero indicating a population density akin to the city’s average population density.

- Adoption rates: The percentage of households in an area that subscribe to broadband internet. This is a survey question from the 2019 five-year American Community Survey. This was also standardized using StandardScaler, with zero indicating the mean proportion of houses subscribed to broadband internet.

- Competition: The number of competitors in the block group according to the unique count of “ProviderName” for each block group in the FCC’s Form 477. Zero means that the area has no other options for wireline internet.

Acknowledgements

We thank Regina Nuzzo (Gallaudet University), Michael Lavine (University of Massachusetts Amherst), Jonathan Mayer (Princeton University), and Karen Mossberger (Arizona State University) for reviewing an early draft of this methodology.

We also thank Andy Guess (Princeton University), Piotr Sapiezynski (Northeastern University), Ross Teixeira (Princeton University), Paul Udit (University of California, Santa Barbara), and Micha Gorelick for guidance and technical help.